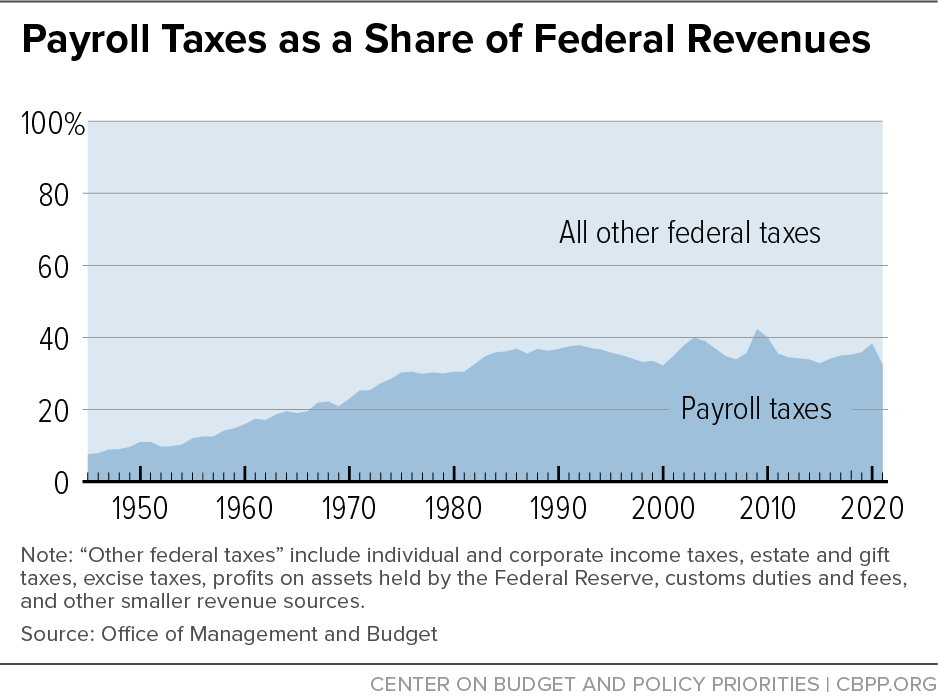

Wage Cap Allows Millionaires to Stop Contributing to Social Security on February 24, 2022 - Center for Economic and Policy Research

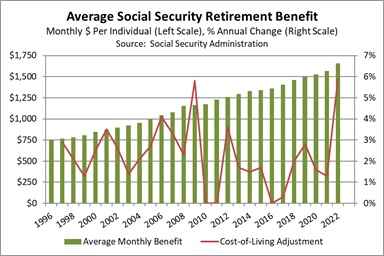

Asset Allocation Weekly - The Inflation Adjustment for Social Security Benefits in 2022 (October 22, 2021) - Confluence Investment Management

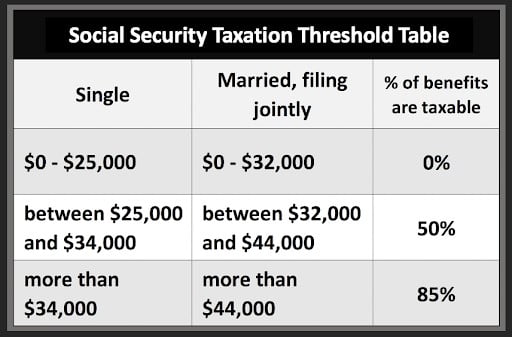

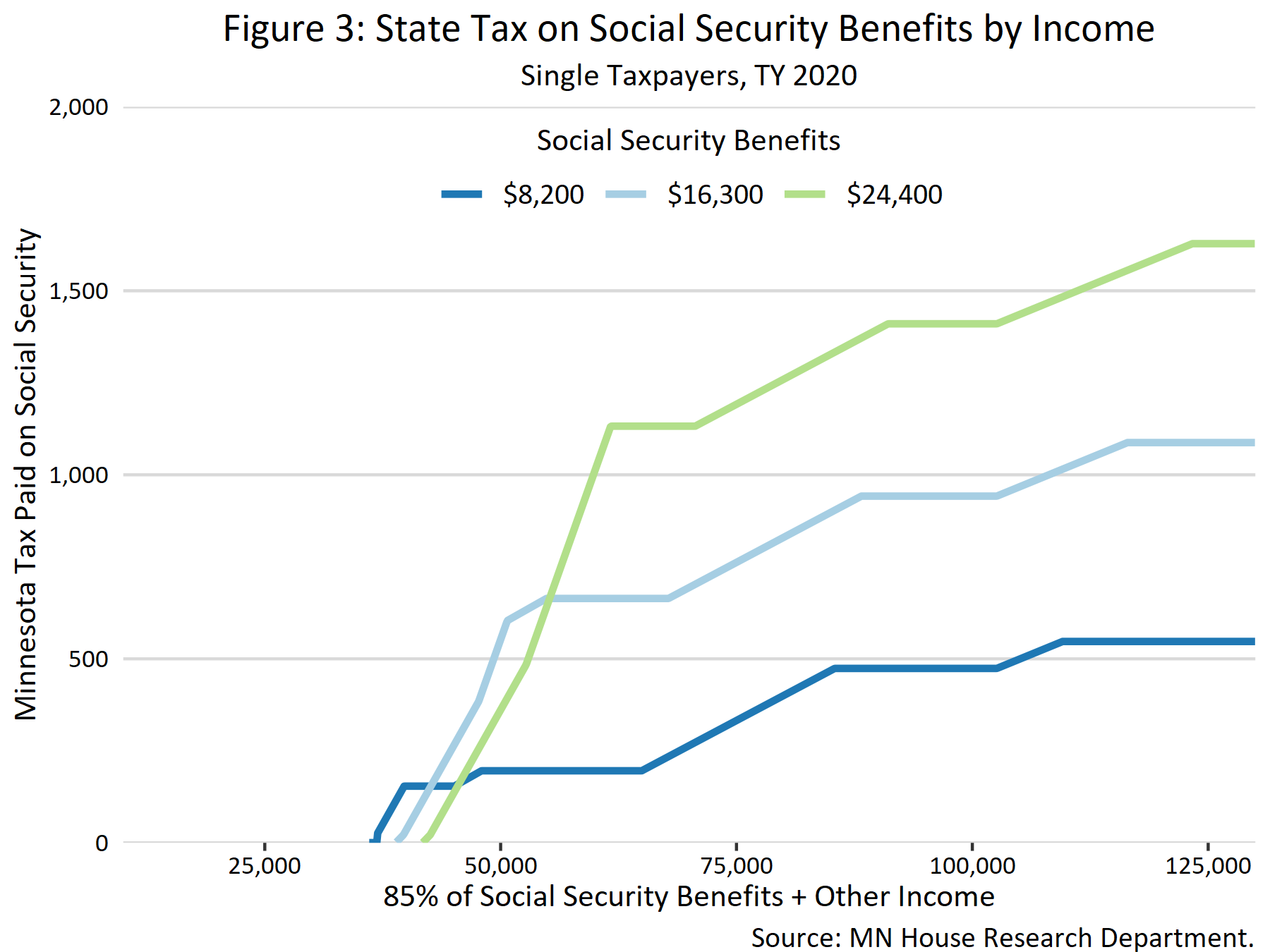

Publication 915 (2022), Social Security and Equivalent Railroad Retirement Benefits | Internal Revenue Service

:max_bytes(150000):strip_icc()/fica-taxes-social-security-and-medicare-taxes-398257_FINAL-5bbd10af46e0fb00266df9ec-b3794e561e094118ad5b5ed3c6898880.png)