CBRE's 2021 U.S. Real Estate Outlook: Speed of recovery mixed with quicker rebound for industrial and data centers | The McMorrow Reports

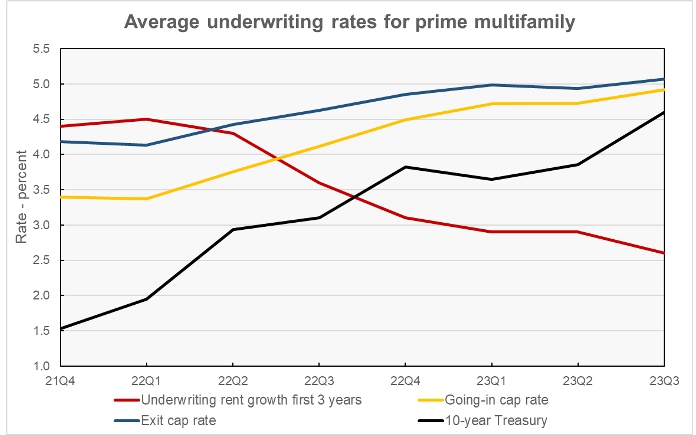

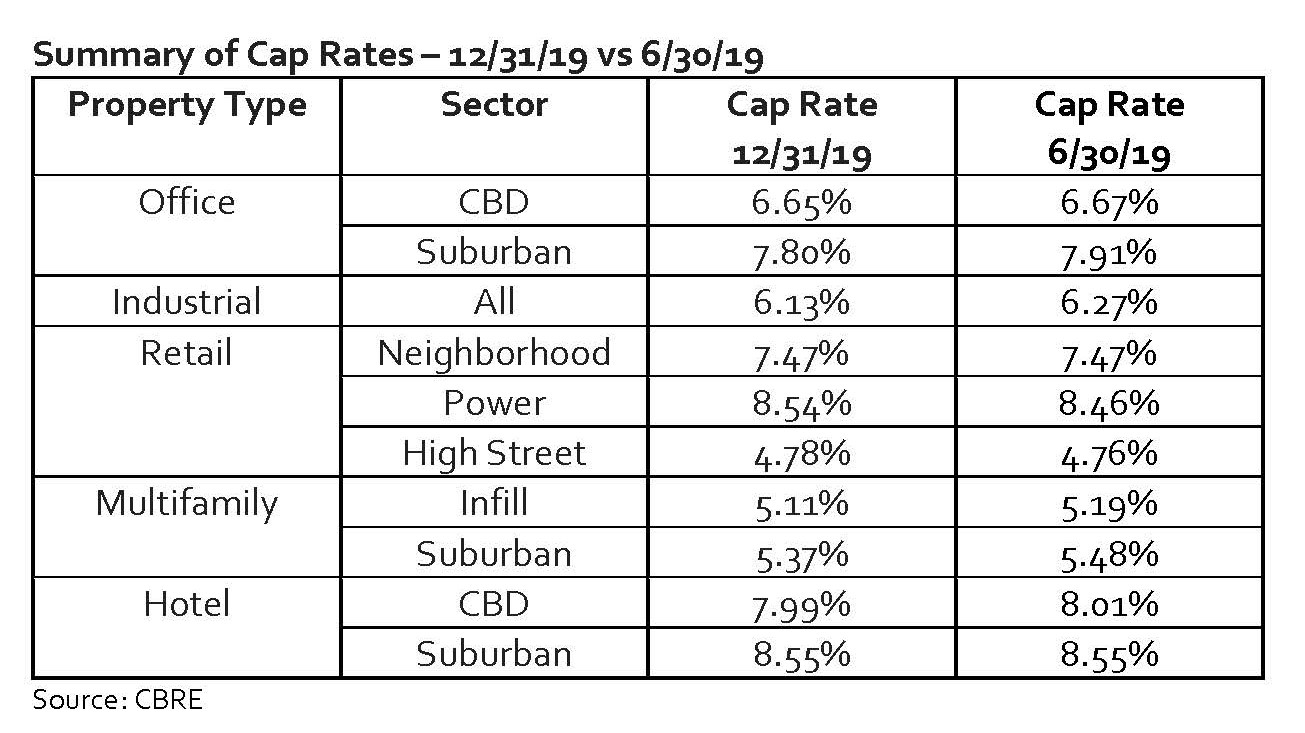

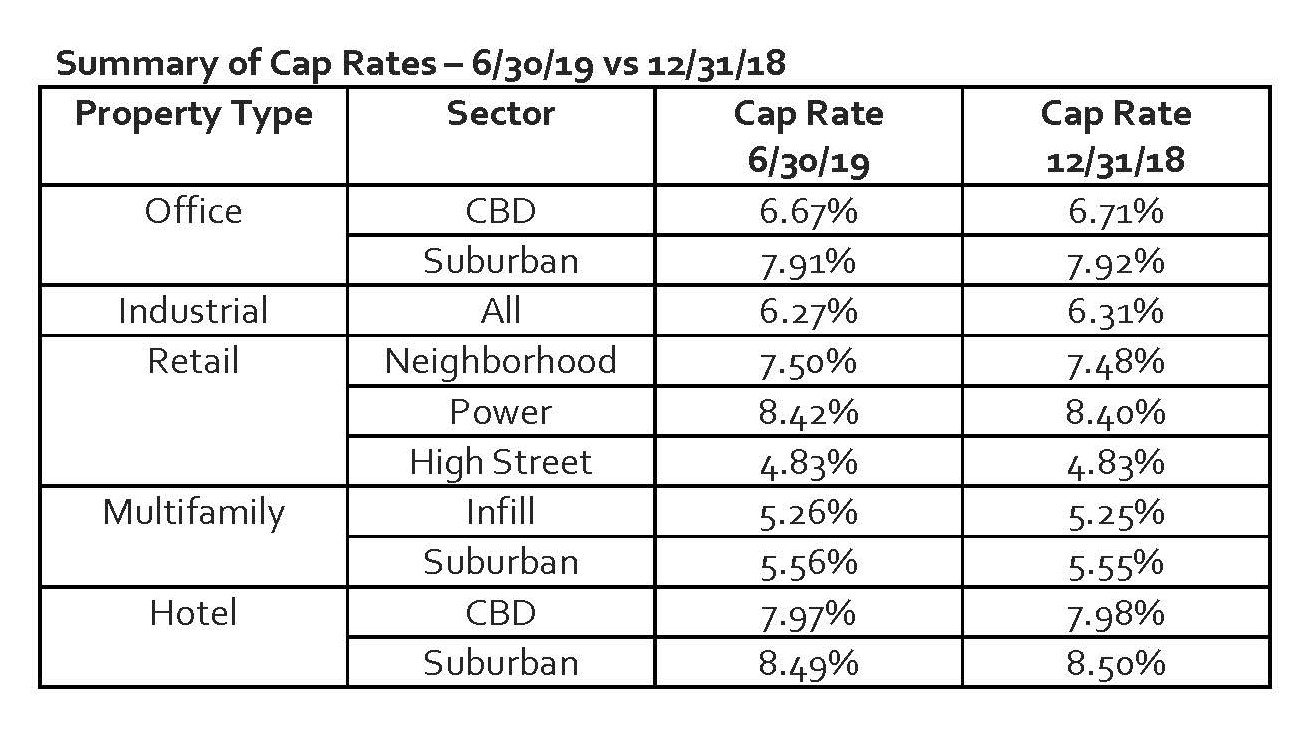

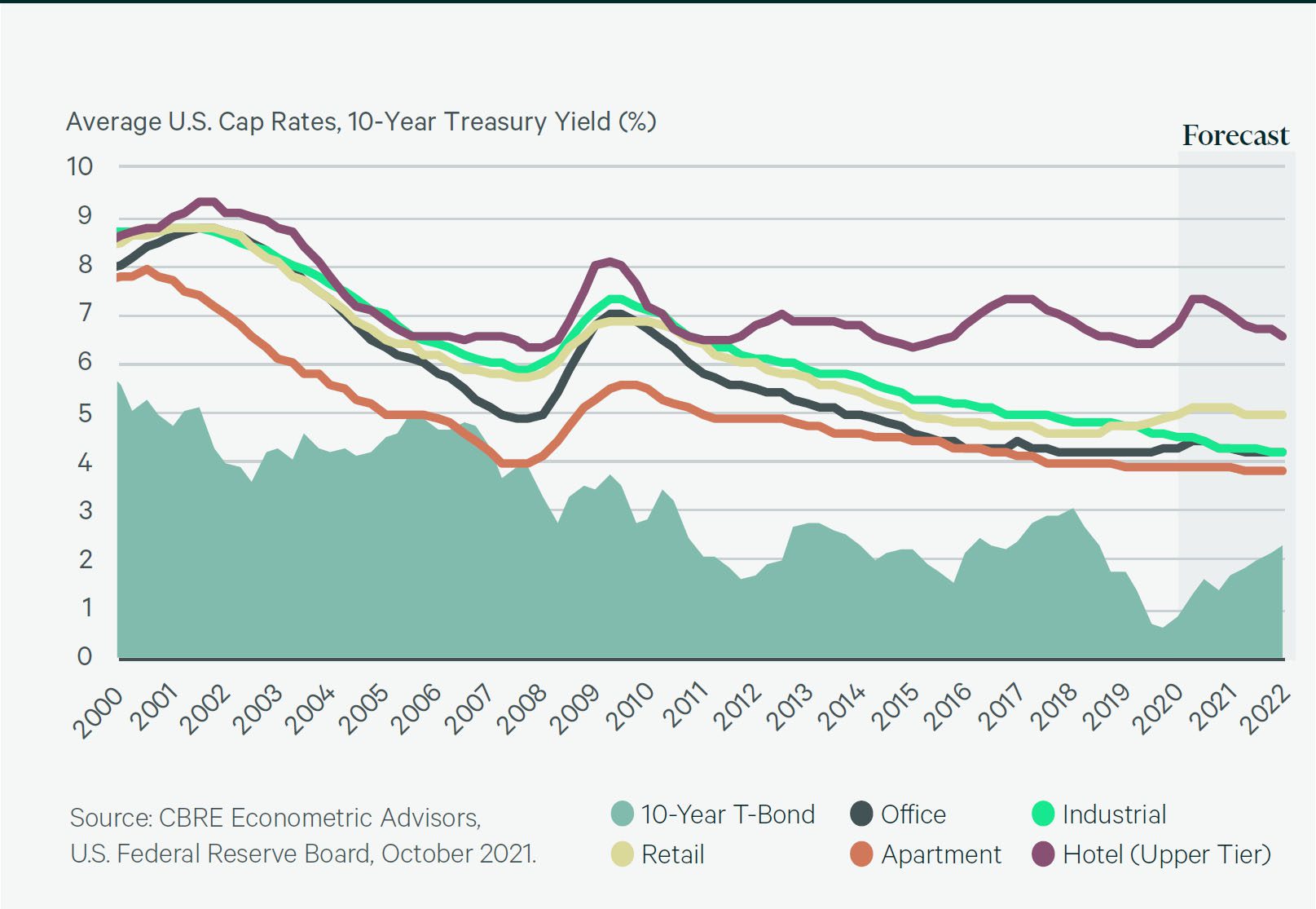

CBRE - Market conditions are changing amid high inflation and rising interest rates. CBRE's H1 2022 U.S. Cap Rate Survey provides an early perspective on pricing trends across asset classes. https://cbre.co/3QVtGN8